Cal Poly Finance Team Advances in Global Competition with Analysis of PayPal Stock Outlook

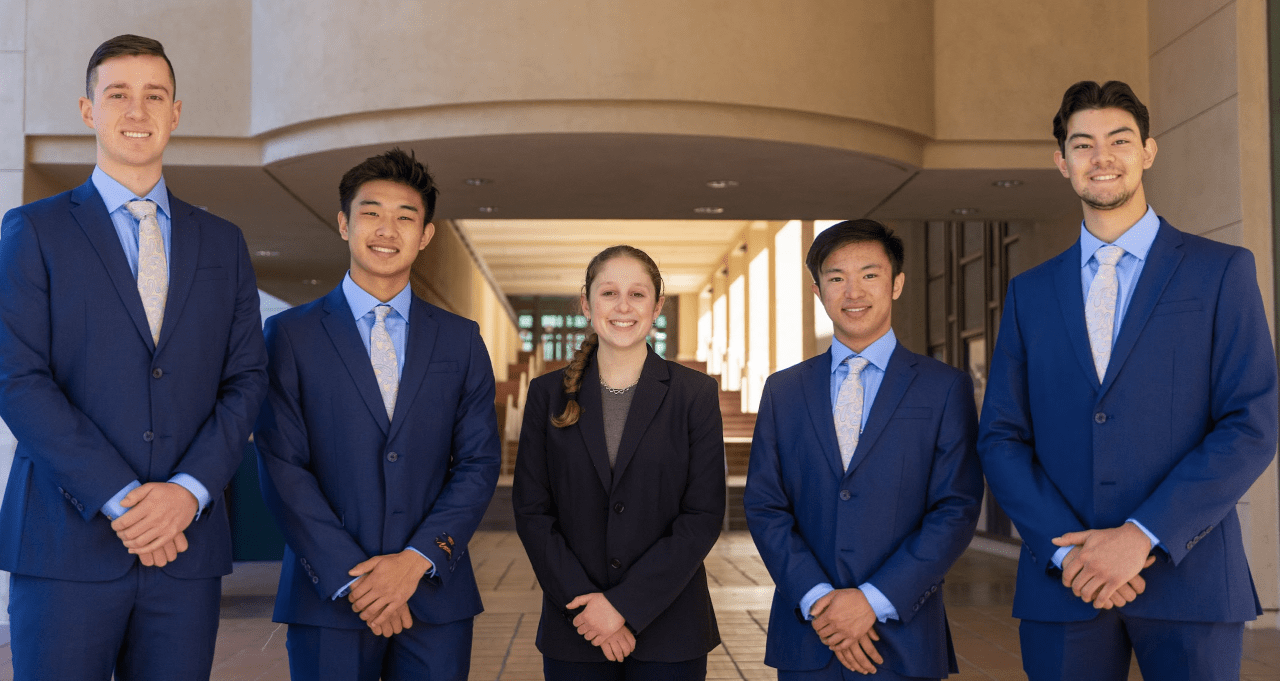

The finance students who participated in the CFA Institute Research Challenge included, from left, Dominic Juliano, Samuel Paik, Alexandra Joelson (team captain), Cameron Wong, and Shingo O’Flaherty represented Cal Poly in the annual global competition. (Photo: Austin Ma)

A detailed analysis of PayPal’s stock outlook, with a recommendation to sell, helped a team of Cal Poly students surpass hundreds of others recently in the CFA Institute Research Challenge.

Competing with over 900 schools from North, Central and South America, the Cal Poly team was just one of 17 that advanced to the Americas’ semifinals this month, having won the local and subregional stages. The competition includes over 5,000 undergraduate and graduate students from universities in more than 91 countries. Students are tested on their analytical, valuation, report writing and presentation skills.

For the competition, students were assigned to perform an analysis of PayPal, a San Jose-based company providing financial transaction processing services. The team spent five months compiling a report — which included information about PayPal’s business model, an industry overview, risks and more – before making a recommendation to sell PayPal stock, projecting its value would decrease by over 12 percent within a year.

“Developing this report may be one of the hardest and most extensive projects we have ever worked on,” said team captain Alexandra Joelson, of San Diego. “We were confined to 10 core pages and 10 appendix pages, and though that may seem like a lot, we had such an abundant amount of research and analysis, it was difficult to keep it to this page limit.”

Screenshot from the team’s report.

The team also included Cameron Wong and Dominic Juliano, both from San Francisco; Samuel Paik, of Orinda, CA; and Walnut Creek, CA, resident Shingo O’Flaherty.

“Early on, our team members identified each individual’s skills and talents,” said faculty advisor Cyrus Ramezani, a finance professor in the Orfalea College of Business. “They then divided the work and specialized to be most effective. This is the closest our students can get to a real world experience. It is also one of the best examples of our Learn by Doing mantra at the Orfalea College of Business.”

Cal Poly alumnus Scott B. Kirk (Business Administration, Financial Management, ’05) also served as team advisor.

Once tasks were assigned, the team studied PayPal, its market and revenue drivers, then worked as a team to develop a detailed financial model, write a comprehensive report, and prepare their presentations.

“This financial model helped us find key conclusions that could drive our sell story,” Joelson said.

That story, Ramezani said, was delivered in a well-written and thoroughly developed report – with extensive use of graphs and charts — that could be used by portfolio managers to make investment decisions.

“Students also created a comprehensive slide deck and made multiple presentations to industry professionals (the judges),” he said. “They are expected to clearly present and defend their analysis and investment recommendation.”

According to their research, PayPal’s competitors include Apple Pay, Google Pay and Zelle, and its current demographic is largely consumers between 35 and 55. While the company benefited from the shift to online shopping, particularly during the pandemic, encroachment by powerful competitors, a rise in interest rates and inflation, plus geopolitical risk, contribute to a questionable stock future, the team concluded.

Screenshot from the team’s report.

Because the project lasted several months, that analysis was subject to change. The report even includes reference to the recent war in Ukraine, which began during the project.

“It was extremely difficult to update our presentation due to the volatility of the market and the constant fluctuation in PayPal news,” Joelson said. “The team set up a plan of exactly what we wanted to update to ensure we had the most up-to-date and accurate presentation possible.”

After winning first place at the local competition in San Francisco (16 teams), the team also advanced from the Western U.S. round to the Americas semifinals. The team did not advance to the Americas finals, which take place April 28.

“The competition is extremely competitive at the semifinal stage, and we may have been eliminated by a fraction of a point,” Ramezani said. “Still, this is the first time our students have reached this level and we are proud of the work our team has completed.”

Joelson credited Ramezani for helping her develop a new sense of passion for finance.

“This project gave me a perspective into what the ‘real finance world’ is like, and I now feel prepared to enter the workforce with confidence,” she said.