Frequently Asked Questions

The Low Income Taxpayer Clinic (LITC) is an organization that represents low-income taxpayers involved in controversies with the Internal Revenue Service. The LITC also provides education and outreach services on the responsibilities of U.S. taxpayers to individuals who speak English as a second language (ESL). The LITC can help taxpayers respond to IRS notices, correct account problems and resolve tax disputes. These services are provided at no charge.

No. The LITC deals with controversies with the IRS.

If you are a low-income taxpayer who cannot afford professional tax services, you may qualify for the LITC. The LITC chooses to represent clients on a case-by-case basis. This decision is often determined by income guidelines and other criteria. Prospective Clients Page.

Some of the issues the LITC resolves include, but are not limited to the following:

- Amended tax returns

- Failure to file prior tax returns

- Installment agreements

- IRS notices

- IRS liens and levies

- Innocent and injured spouse relief

- Tax audits

- Earned Income Tax Credit eligibility

- Child Tax Credit eligibility

- Identity Theft

You should first contact the LITC to discuss your tax problem. The LITC will then determine if you qualify for their services. If you do qualify, the clinic will ask for information and documents necessary to resolve your tax issue.

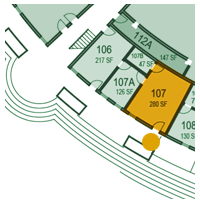

The LITC is located at:

California Polytechnic State University

1 Grand Ave

Building 3 - Room 107

San Luis Obispo, CA 93401

The Cal Poly LITC represents individuals in San Luis Obispo, Southern Monterey, and Northern Santa Barbara Counties. If you have any questions or concerns regarding your eligibility, you can call the LITC. If you are not located in one of the listed counties, the Cal Poly LITC can introduce you to other Low Income Taxpayer Clinics located throughout California.

Yes. LITC services for ESL (English as a Second Language) include:

Educational outreach programs regarding federal taxpayer rights and responsibilities.

Direct consultation regarding their rights and responsibilities as U.S. taxpayers.

Ancillary assistance in the preparation of federal tax returns or other required tax forms.

There are various types of 30-day, and even 90-day, letters. Call the LITC and a student accountant will help you in determining what type of letter it is, and what action to take next.